Have you ever had someone abroad say, “I’ve sent the money,” but three days later, you’re still refreshing your account like it’s a Netflix episode that just won’t load?

Well, you’re not alone.

For many Africans, receiving money from overseas still feels like a waiting game, hidden fees, exchange rate drama, and transfers that take forever to reflect.

But thankfully, things are changing fast.

Today, we’ll walk through how to receive money from abroad in 2025, exploring the most reliable methods, what really works, and how platforms like nsave are making cross-border payments easier, faster, and actually fair for everyone.

Let’s check them out:

Table of Contents

Toggle1. Bank Transfers (Direct to Bank Account)

One of the most common and traditional ways people still use to receive money from abroad is through a direct bank transfer.

It’s simple: the sender initiates a transfer from their foreign bank using your account number, name, and SWIFT/BIC code, and the money lands in your local account after passing through a few intermediary banks.

In most cases, it takes about one to five business days, but that depends on how many banks the transfer passes through.

Some transactions take longer because intermediary banks sometimes hold funds for extra checks. It’s the classic “safe but slow” method.

However, it’s not without its realities. Banks don’t always give you market exchange rates, they use internal conversion rates that can make a noticeable difference, especially for large payments.

Also, receiving money this way can attract multiple fees, from the sending bank, the intermediary bank, and even your local bank when crediting your account.

So while you can absolutely receive money from abroad in your bank account, it’s not always the cheapest or fastest way to go.

Pros:

- Safe, regulated, and ideal for large payments or business transactions.

- Goes directly into your bank account, no extra apps needed.

Cons:

- Long processing times (especially during holidays or international audits).

- High and often unclear deductions from exchange differences and intermediary fees.

Tips:

- Always confirm your bank’s SWIFT code before sharing.

- Ask your sender to choose the “OUR” option so they cover all fees.

- Stick to banks known for smooth international transfers (e.g., GTBank, Zenith, Access Bank).

2. Remittance Services (Western Union, Wise, Remitly & Others)

If you’ve ever received urgent funds from a loved one or client, you probably already know how to receive money from abroad through platforms like Western Union, MoneyGram, Wise, or Remitly.

These services have built trust for decades, but in recent years, digital-first platforms like Wise have made the process much faster and more transparent.

They’re easy to use. The sender enters your name, country, and amount, then pays via card or bank.

Depending on the platform, you can either collect the cash in person or have it sent directly to your Nigerian bank account.

Transfers can arrive within minutes, especially through Wise or Remitly, though cash pickups may take a few hours longer.

The beauty of these services lies in convenience, but here’s the human truth: they can be unpredictable. Sometimes your transfer that “usually takes minutes” might take days if the sender’s card triggers a fraud check or if local compliance officers need to verify the transaction.

There are also quite deductions through slightly adjusted exchange rates, which add up over time.

Pros:

- Fast, secure, and accessible from almost anywhere.

- Online tracking and transparent fees for most digital platforms.

Cons:

- Exchange rates may fluctuate, and “zero fee” claims often hide rate markups.

- Cash pickups can require ID verification and sometimes long queues.

Tips:

- Use apps like Wise or Remitly for digital transfers; they’re quicker and less stressful.

- Always make sure your name matches your ID exactly to avoid failed transactions.

- Check rate calculators before each transfer to ensure you’re not losing money unknowingly.

If you prefer to receive money from abroad online, remittance services are still one of the most reliable ways to go.

3. Payment Platforms and Digital Wallets (nsave)

Now, this is where the modern revolution in cross-border payments really shows.

For freelancers, remote workers, and digital creators, the best answer to how to receive money from abroad today lies in payment platforms and digital wallets, especially innovative ones like nsave.

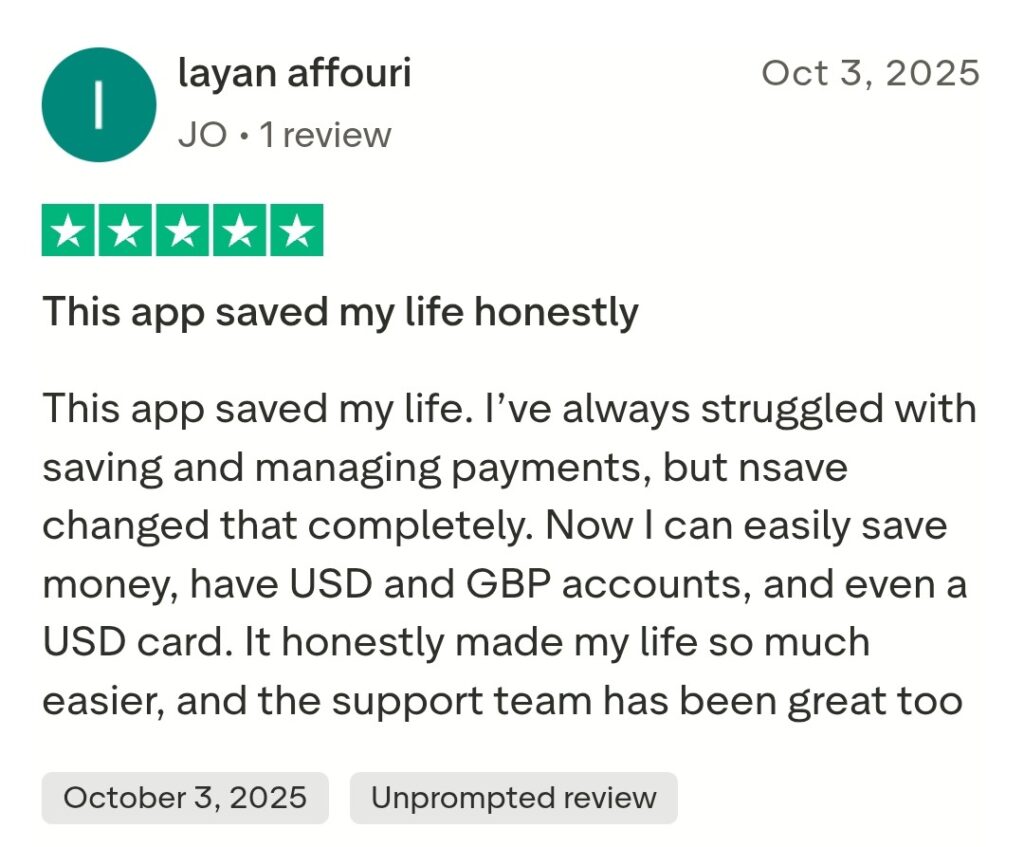

nsave is quickly becoming a trusted name for people in high-inflation countries who want to safely receive and store money in stable currencies.

It offers users virtual accounts in USD, GBP, and EUR, allowing them to receive payments directly from international clients or platforms.

What sets nsave apart is that it partners with regulated financial institutions in Switzerland and the UK, meaning users’ funds are held under strict global standards, a level of security local banks rarely match.

Using nsave feels like having your own foreign bank account. Once verified, you can receive money from clients abroad, hold it in stable currency, and withdraw to your local account whenever you choose.

The flexibility to decide when to convert your funds (based on better exchange rates) is a game-changer for anyone paid in foreign currency.

That said, there are some realities to keep in mind.

Account verification (KYC) is required(a simple NIN will do, for Nigerians).

Dollar deposits and withdrawals to your naira bank account are free with competitive exchange rates.

It’s already being used by many freelancers and some reviews say it’s a freelancer’s best friend.

While nsave is changing how Africans receive and manage cross-border payments, it’s not alone in the game.

Other digital wallets like Grey, Geegpay, Chipper Cash, and Revolut have also made how to receive money from abroad simpler and more accessible, especially for freelancers and remote workers.

They let you hold multiple currencies, convert funds easily, and withdraw straight to your local bank, all from your phone.

However, what sets nsave apart is its reliability, partnership with Creaitz, and its focus on helping Africans build financial stability while getting paid faster and more transparently.

Pros:

- Let’s you receive, hold, and manage foreign currencies safely from anywhere in the world.

- Backed by regulated partners in Switzerland and the UK.

- Compliant and with transparent fees

- Easy-to-use app

- You can get a virtual MasterCard USD card to use for transactions

- Receive crypto (like stablecoins) or fiat(like USD, GBP).

- WhatsApp support available

Cons:

- Verification can take time if you use the wrong document during onboarding.

Tips for Using Payment Platforms like nsave:

- Use the right document to complete your verification early

- Check the conversion rate before withdrawing; timing matters.

- Review fees beforehand so you always know what you’re paying for.

What everyone wants today is control, transparency, and speed, nsave stands out as one of the most practical ways to enjoy these and also receive money from abroad online.

It bridges the gap between traditional finance and the digital future, thus giving you peace of mind, flexibility, and global access that typical banks still struggle to provide.

4. Cryptocurrency (Bitcoin, USDT, and Stablecoins)

Another increasingly popular method for people looking for how to receive money from abroad is through cryptocurrency.

It’s fast, borderless, and not tied to any government’s control, which is exactly why many freelancers, entrepreneurs, and even families now use it for cross-border transfers.

Here’s how it works.

The sender buys a cryptocurrency like USDT (Tether) or Bitcoin and sends it to your crypto wallet address.

Once you receive it, you can either keep it as crypto or convert it to naira through a trusted peer-to-peer (P2P) exchange.

Depending on network congestion, the whole process can take as little as a few minutes to one hour, making it one of the fastest ways to receive money internationally.

The real appeal of crypto is control, you decide when to convert, what rate to use, and which wallet to hold it in.

Plus, stablecoins like USDT are pegged to the US dollar, meaning they don’t fluctuate as wildly as Bitcoin or Ethereum. This gives users a digital version of the “dollar account” they never had.

But it’s not without its risks. Regulatory issues in Nigeria have made crypto transfers more complicated, and scams are still a problem for those who don’t verify who they’re trading with.

You also need a solid understanding of wallets, private keys, and security practices, because once funds are sent to the wrong address, they can’t be recovered.

Still, in 2024, Chainalysis ranked Nigeria among the top 10 countries in global crypto adoption, showing just how much trust people have developed in using crypto for remittances.

Pros:

- Fast, borderless, and available 24/7.

- Avoids traditional banking fees.

- Stablecoins like USDT protect against currency depreciation.

Cons:

- Price volatility (for non-stablecoins).

- Requires crypto literacy and security awareness.

- Regulations can change suddenly.

Tips:

- Use only trusted wallets like Trust Wallet or Binance.

- Confirm wallet network (ERC20, TRC20, etc.) before receiving funds.

- Always verify traders before doing P2P exchanges.

If you’re looking for how to receive money from abroad with more independence and speed, crypto is a reliable alternative, as long as you stay informed and careful.

5. Freelance and Global Payment Platforms

For freelancers, creatives, and remote professionals, platforms like Upwork, Fiverr, Toptal, and Deel have become major lifelines for how to receive money from abroad.

They’ve not only made it easier to find global clients but also simplified international payments in ways traditional systems never could.

Here’s how it typically works. When you complete a project or gig, the client pays the platform (in USD or another foreign currency).

The money sits in your platform wallet until you withdraw it to your connected account, which could be Payoneer, Wise, or your local bank.

The beauty of these systems lies in trust and structure. Clients don’t have to worry about sending money through unreliable means, and freelancers don’t have to chase payments.

But there are also some realities. Payment processing can take a few days (especially if weekends or public holidays are involved).

Exchange rates vary, and some platforms charge withdrawal fees. Still, the reliability outweighs these concerns for most people.

Pros:

- Secure payments with built-in buyer protection.

- Easy integration with payment methods like Payoneer or Wise.

- Builds credibility with clients through verified platforms.

Cons:

- Platform fees (usually 10–20% per project).

- Conversion rates may differ depending on the withdrawal method.

- Payout delays during holidays or maintenance periods.

Tips:

- Set up multiple withdrawal options in case one fails.

- Always double-check currency settings before confirming withdrawal.

- Keep transaction screenshots for tax or income documentation.

If you’re a freelancer wondering how to receive money from abroad to Nigeria without stress or confusion, using trusted global platforms remains one of the safest and most professional methods available today.

6. Gift Cards and Alternative Value Transfers

While not the most conventional, gift cards have quietly become another creative way people explore how to receive money from abroad, especially for smaller payments or quick settlements.

It’s not ideal for large sums, but it’s still widely used among students, digital entrepreneurs, and social media vendors.

Here’s how it works: someone abroad purchases a gift card (Amazon, Steam, Apple, or Visa) and sends the details to you.

You can then sell that gift card on a trusted exchange platform or to a verified dealer for naira. In many cases, this method offers quick liquidity, especially when traditional transfers aren’t an option.

However, it comes with a few realities. Gift card rates fluctuate based on demand, and some dealers charge steep commissions.

Plus, there’s always a risk of fraud if you don’t verify who you’re dealing with. For instance, some scammers send used or invalid cards, which can’t be redeemed.

So while it’s not the most reliable long-term strategy, it’s still an option for those who need a fast workaround.

Pros:

- Fast and easy to process for small payments.

- Doesn’t require a bank account or verification.

- Works even when other payment channels are down.

Cons:

- Unstable exchange rates.

- High risk of scams if done with unverified buyers.

- Not suitable for large or business-related transactions.

Tips:

- Use reputable exchange platforms with verified reviews.

- Avoid trading with unknown dealers on social media.

- Always confirm the value of the gift card before trading.

Gift cards might not be the most traditional solution, but they’ve proven useful in certain cases where flexibility and speed matter more than formal banking.

7. Money Transfer Agents and Local Payment Partners

Finally, there are still people who prefer using local money transfer agents, trusted intermediaries who handle the process of how to receive money from abroad on your behalf.

These are individuals or small businesses with access to global remittance channels, often connected to large international networks.

Let’s say a family member in the UK wants to send you money. They send it through the agent’s partner abroad, and the agent pays you in naira locally (either in cash or direct bank transfer).

It’s fast, sometimes same-day, and often more flexible than official banks.

However, the main concern here is trust. You need to be absolutely sure the agent is legitimate, transparent about rates, and compliant with regulations.

There have been cases where unregistered agents disappeared with funds or delayed payouts due to network issues.

Still, in some smaller Nigerian towns where digital access is limited, these agents play a crucial role.

Pros:

- Fast and simple, often instant.

- Can be done without internet access.

- Agents offer flexibility on exchange rates.

Cons:

- Risk of fraud or delayed payments.

- Hard to trace transactions if problems occur.

- Not ideal for business or large transfers.

Tips:

- Always use licensed and recommended agents.

- Confirm the sender’s reference code or payment proof before collecting.

- Keep receipts or evidence of every transaction.

Money transfer agents might not be the future of fintech, but they remain part of the reality for millions of Nigerians still exploring how to receive money from abroad efficiently and safely.

Frequently Asked Questions

1. Can I receive money from abroad directly into my Nigerian bank account?

Yes, you can, but it depends on the bank and the sender’s method.

For example, banks like GTBank, Zenith, and Access Bank support international remittances through partners like Western Union or MoneyGram.

However, the process can sometimes be slow, and the exchange rate might not be the best.

If you want something faster and cheaper, try fintech platforms like nsave, Grey, or Geegpay that let you create foreign currency accounts.

2. What’s the safest way to receive money from abroad?

The safest method depends on what matters most to you. speed, security, or cost.

For many Nigerians, fintech platforms (like nsave, Wise, and Payoneer) are considered safe and reliable because they’re regulated and have built-in verification systems.

But if your sender prefers cash, a bank or Western Union transfer might be better.

The key is to always use verified platforms, never random social media traders.

3. How long does it take to receive money from abroad?

Timing depends on the method used. Bank transfers usually take 2–5 business days, while fintech apps and crypto payments can land within minutes or hours.

Platforms like Wise and nsave often complete transfers the same day, which is why they’ve become so popular among freelancers and families receiving money from overseas.

4. Why do I get less money than what was sent to me?

That’s usually because of exchange rates and hidden fees.

When someone sends you $100, the platform might charge a service fee or use a lower exchange rate when converting to naira.

Always check the rate before confirming a transaction. Apps like Wise or Grey show real-time conversion rates so you know exactly how much you’ll receive.

5. What apps can I use to receive money from abroad?

There are plenty of good ones.

Some of the most popular are nsave, Wise, Payoneer, Chipper Cash, Geegpay, and Grey.

They all make it easy to open a foreign currency account, get paid, and withdraw in naira when you’re ready.

It’s one of the easiest ways for freelancers, remote workers, and families to manage international payments today.

6. Can someone abroad send money to my Naira account directly?

Sometimes yes, but it’s not always the best option. Many banks require international transfers to go into domiciliary accounts (USD, GBP, or EUR) instead of naira accounts.

That’s why fintech apps or remittance platforms are often better; they handle the conversion for you and let you receive naira instantly at competitive rates.

7. Why is my money taking so long to arrive?

Delays happen for different reasons, sometimes due to bank holidays, compliance checks, or incomplete sender information.

If it’s been more than five business days, contact the sender’s provider with your transaction reference number.

Fintech platforms usually offer faster support compared to banks.

8. What’s the easiest way to receive money from abroad as a freelancer?

Most freelancers use Payoneer, nsave, or Grey because they integrate smoothly with platforms like Upwork and Fiverr.

You can get paid in dollars or pounds, hold it in your wallet, and then withdraw to your Nigerian account at your convenience.

It’s fast, stress-free, and far more flexible than waiting days for a wire transfer.

Your Next Step Starts Here

At the end of the day, everyone just wants one thing: to make sure the money they’ve worked hard for gets home safely, quickly, and in full.

Whether it’s a client, a loved one, or a friend sending you cash, you deserve a process that actually works without stress or endless waiting.

That’s why it helps to stay informed and connected. The more you know, the easier it gets to pick what truly works for you, whether that’s nsave, Wise, or any other trusted platform.

And if you’re serious about growing your digital skills and staying ahead of trends like this, you don’t have to do it alone.

Join the Creaitz community, where creators, freelancers, and digital learners like you learn how to earn smarter, work better.

Recommended for You: